direct vs indirect cash flow gaap

The indirect method works from net income so the bottom of. This is done automatically under the indirect method.

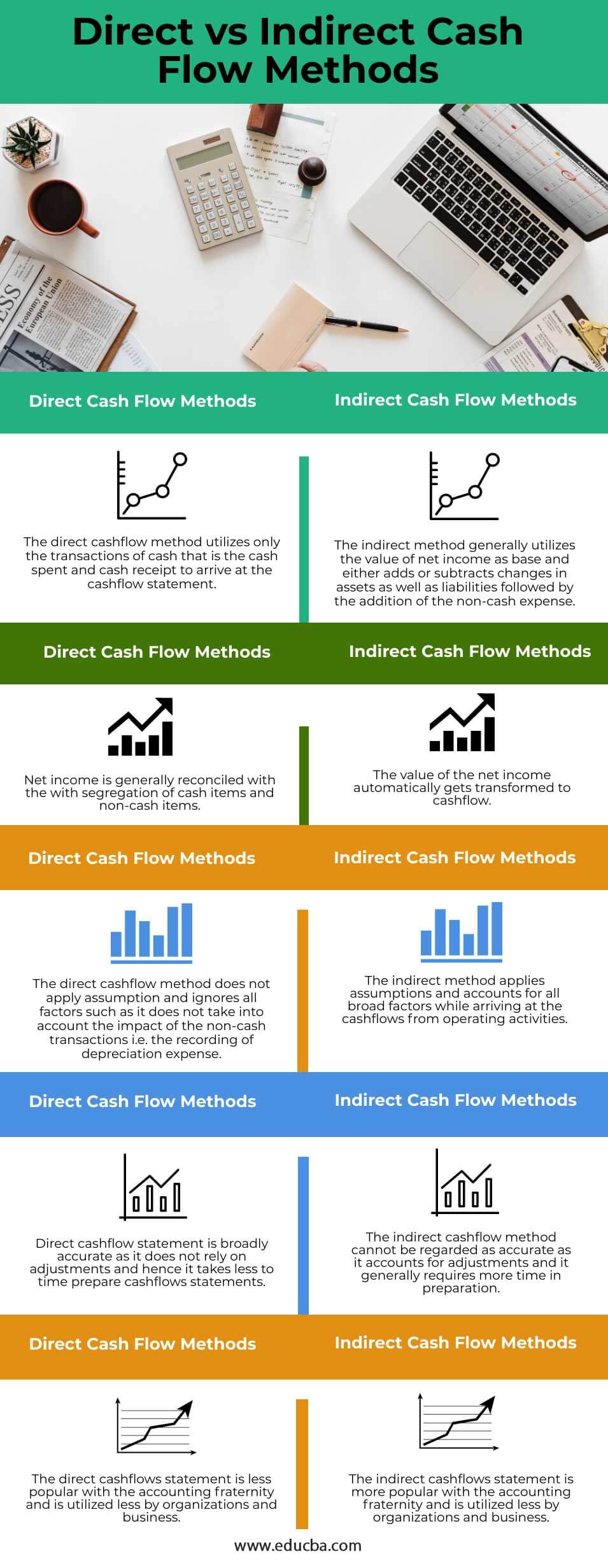

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Under the indirect method net.

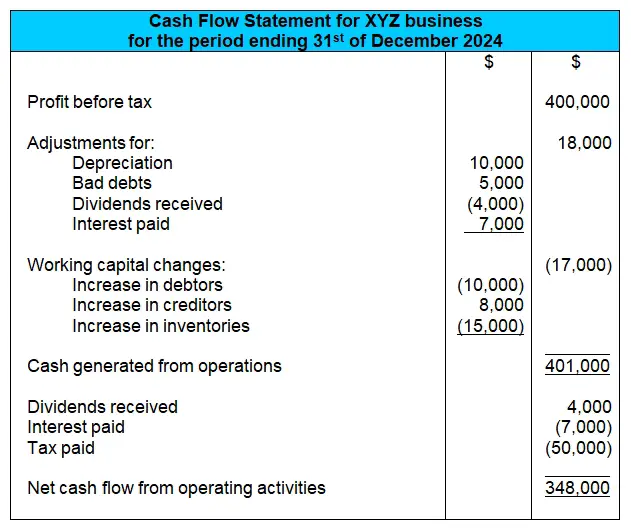

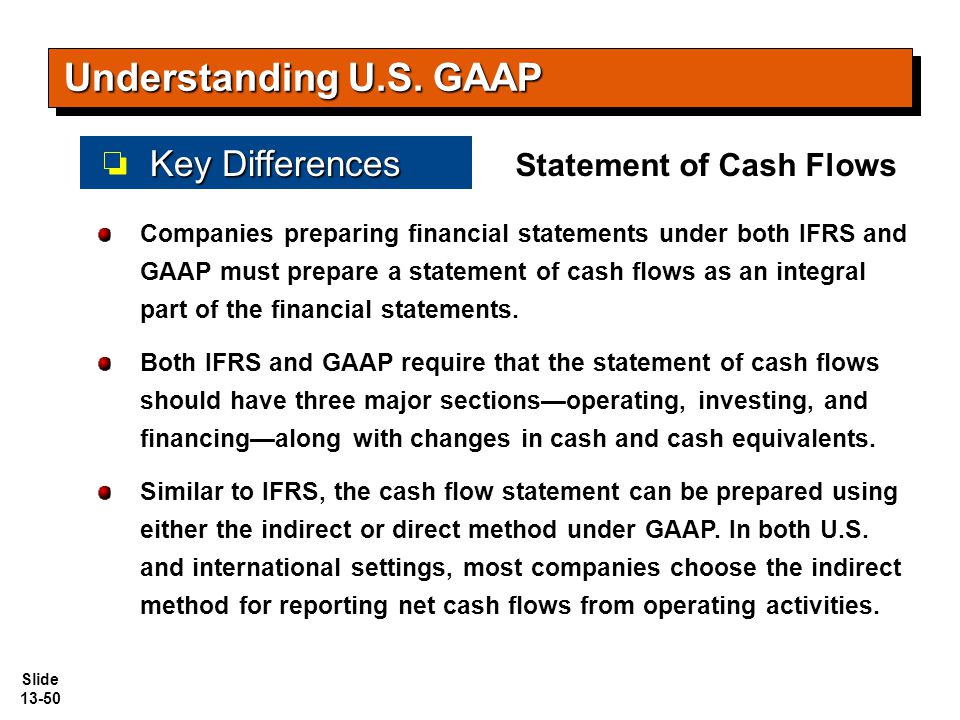

. The direct method of cash flow statement takes more amount of time to prepare than the indirect method of cash flow statement. Interest received must be classified as an operating activity. In contrast the indirect method starts with net income for-profit entities or the change in net assets NFP entities adds back non-cash expenses removes gains and losses and adjusts for the changes in current asset and current liability accounts.

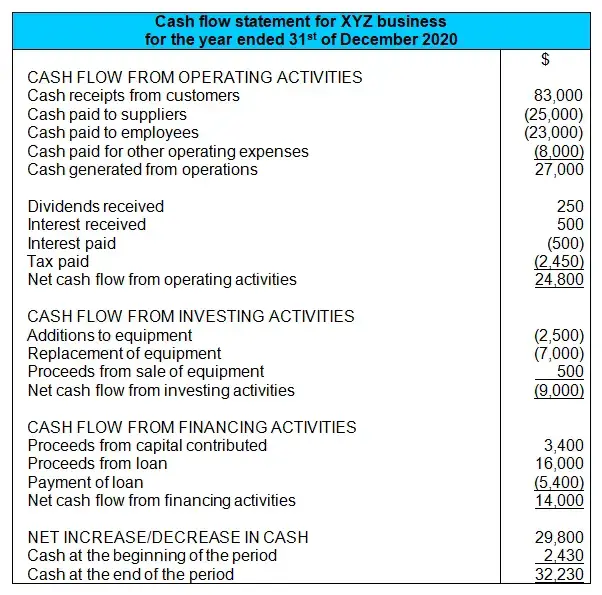

The direct method details where cash comes from and where it goes. Under the direct method the statement of cash flows reports net cash flow from operating activities as major classes of operating cash receipts eg cash collected from customers and cash received from interest and dividends and cash disbursements eg cash paid to suppliers for goods to employees for services to creditors. The main difference between the direct method and the indirect method of preparing cash flow statements involves the cash flows from operating expenses.

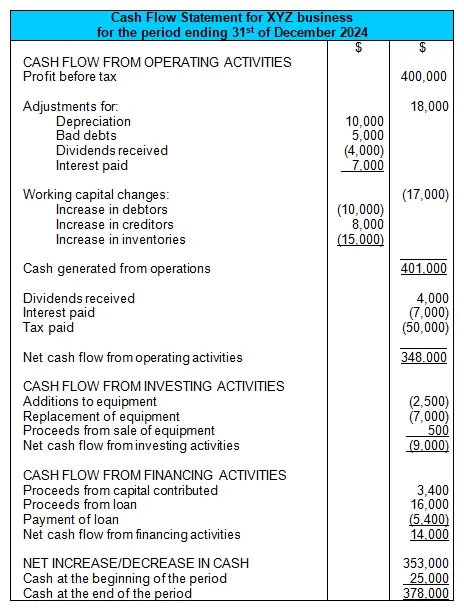

Below is an example of the cash flow from operations segment of a cash flow statement prepared under IFRS using the indirect method. Adjusting net income to operating cash flows is easier and less costly than reporting gross operating cash receipts and payments which is the case in the direct method. The indirect method begins with your net income.

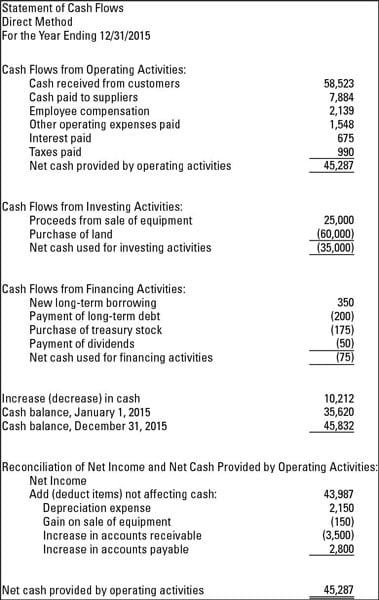

The key difference between direct and indirect cash flow method is that direct cash flow method lists all the major operating cash receipts and payments for the accounting year by source whereas indirect cash flow method adjusts net income for the changes in balance sheet accounts to calculate the cash flow from operating activities. 108 In addition unlike IFRSs US. Cash from customers Cash paid to employees Cash paid to suppliers Cash paid for interest The direct method also requires a reconciliation of net income to the cash provided by operating activities.

The direct method of cash-flow calculation is more straightforward and it shows all your major gross cash receipts and gross cash payments. Concept Monetary For Period. Companies prefer using the indirect method since they are preparing a balance sheet and income statement based on accrual accounting and the indirect method use accrual accounting.

Up to 5 cash back IAS 7 and Section 230-10-45 FASB Statement No. 106 Both encourage the use of the direct method. Under the direct method only the incoming and outgoing funds available at the time of the statement are included.

However of the two the direct method is generally encouraged. It provides a slightly different view than the FASB 95 indirect and direct models. Any money owed is not included as it is not yet in the cash accounts.

Cash flows from investing activities and cash flows from financing activities are the same for a company regardless of whether the direct method or indirect method is used. Alternatively the direct method begins with the cash amounts received and paid out by your business. The direct method the income statement is reformulated on a cash basis rather than an accrual basis from the top of the statement the income part to the bottom the expense part.

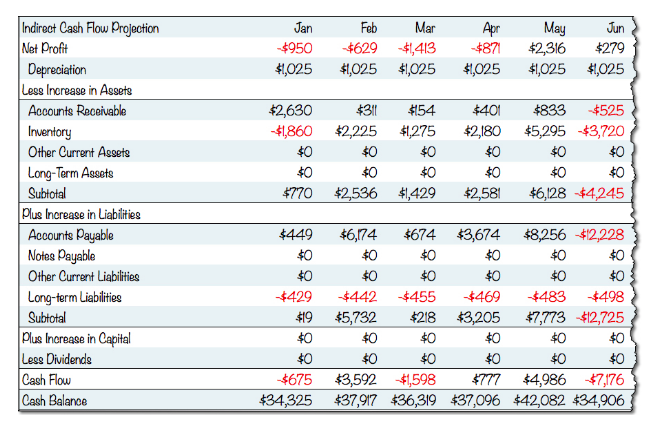

US GAAP also requires similar adjustments. Direct Method or Income Statement Method. Alternatively cash flows from operating activities may be presented by the indirect method.

UCA Cash Flow or Uniform Credit Analysis cash flow is a variation of the FASB95 direct cash flow format. For example if a retailer sells an item on credit the indirect method will consider this as income and reflect this in the figures whereas the direct method wont include it until the bill has been paid. The indirect method backs into cash flow by adjusting net profit or net income with changes applied from your non-cash transactions.

SFAS 95 encourages companies to present cash flows from operating activities using the direct method. Also if a company. Classified Balance Sheet Income Statement with Gross Profit and Operating Income Loss Indirect Cash Flow Statement US GAAP Cash Flows Statement Indirect Method Tree View of same information Examples of Cash Flow Statement.

GAAP requires a reconciliation of net cash flow from. GAAP also calls the indirect method the reconciliation method. 95 permit the direct and the indirect method of reporting cash flows from operating activities.

Here are a few of the more common descriptions that will be seen under the direct method. Direct Financing Lease Selling Loss. The indirect method on the other hand will reflect funds that are owed.

Bank overdrafts are classified as part of cash and cash equivalents Either the direct or indirect method may be used for reporting cash flow from operating activities. The second column provides the general structure of the UCA cash flow statement. The UCA cash flow model has become a standard for the lending industry.

Under the direct method you present the cash flow from operating activities as actual cash outflows and inflows on a cash basis without beginning from net income on an accrued basis. The indirect method on the other hand focuses on net income and may include cash that is not yet in the business. However if a company used the direct method it is also required to show reconciliation between net income and cash flow from operations.

While both are ways of calculating your net cash flow from operating activities the main distinction is the starting point and types of calculations each uses.

Direct Vs Indirect The Best Cash Flow Method Vena

Produce Gaap Compliant Statement Of Cash Flows Reports In Xero Hq Xero Blog

What Is The Difference Between The Direct And Indirect Cash Flow Statement Methods Universal Cpa Review

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Volume Ppt Video Online Download

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

The Direct And The Indirect Method For The Statement Of Cash Flows Online Accounting

The Indirect Cash Flow Statement Method

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

Statement Of Cash Flows Ppt Video Online Download

The Indirect Cash Flow Statement Method

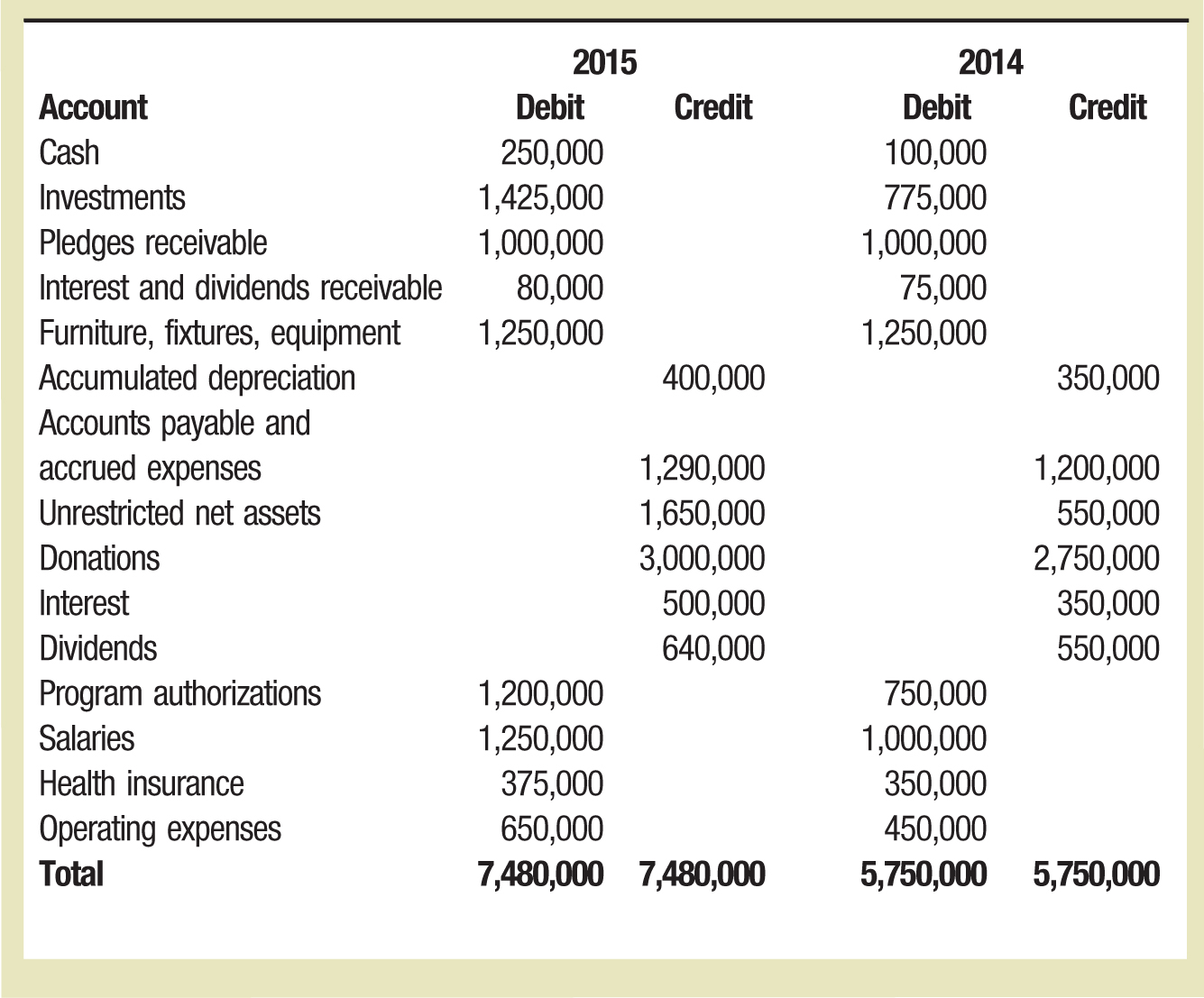

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

The Indirect Cash Flow Statement Method

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

27 Understanding Cash Flow Statements

Methods For Preparing The Statement Of Cash Flows Dummies

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)